The New Year of 2023 is shaping up to be a more challenging year for sellers in the Chicago area as higher interest rates start to impact the market. Chicagoland home sales dipped dramatically to 7,575, which is the lowest total since 2011. First time buyers are struggling as affordability is being hit with higher prices and interest rates. Last year 34% of home sales went to first time buyers and today that figure is only 26%.

But all is not lost as Chicago may prove to be one of the more resilient real estate markets in the country. That’s because the Chicago area remains one of the more affordable housing markets in the country and home equity is very high. Just under 30% of homes in the metro area have no mortgage making Chicago the 3rd highest metro area for home equity in the US. The annual income needed to buy an average home in Chicagoland is $81,000, lower than all of the other 20 top metro areas except Philadelphia. The post-COVID boom drove up prices in Chicagoland by 41.7%, which is one of the smallest increases in the nation.

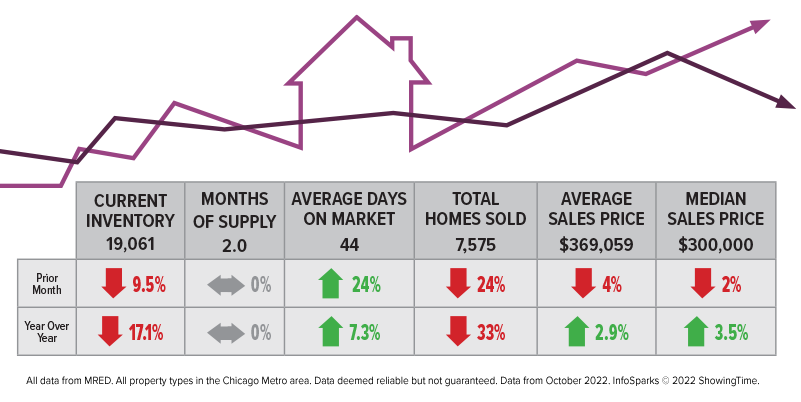

Chicago area home sales have slowed down in 2022 by -33% but prices are still rising. Housing inventory is down -17.1% and finding a home is a challenge. Low inventory will be the seller’s hedge against a recession in 2023, which seems an inevitability at this point. Because of this, the UIC Stuart Handler Department of Real Estate is forecasting prices to increase modestly over the next few months.

Inflation went down for the 3rd month in a row to 7.7%, inflaming the stock market and driving down mortgage rates to 6.625% for a 30-year conventional loan. But the October jobs report showed the US economy adding 261,000 jobs and unemployment at 3.7%. The overheated employment situation means the Fed will likely continue to aggressively raise the Federal Funds Rate, now at 4%, to slow down employment. That means higher mortgage rates and a slower housing market.

Given the runup in prices since 2020 look at the current market as rebalancing, rather than slowing. Sales are strong and as prices moderate, buyers will find more opportunities.

The housing market changes every day. That means you need an experienced professional to guide you. For a free, no-obligation consultation contact us today!