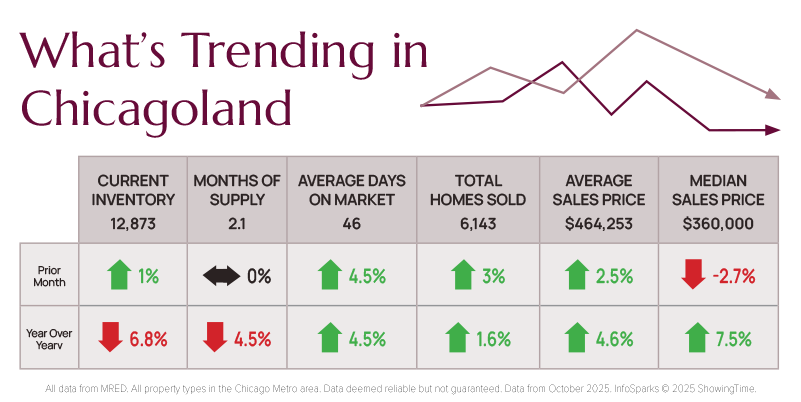

The Chicago area real estate market continues to level off, with sales up only slightly by 1.6%. Inventory fell 6.8%, new listings are down 2.6%, and the month’s supply of homes for sale is at only 2 months. The lack of inventory drove up median prices by 7.5%. On average, it takes less than a month, only 26 days, from the date a property is listed until it is under contract. The market will continue to cool off as we head into the holidays. The Institute for Housing Studies at DePaul University projects a seasonal 13.6% decline in market activity.

The National Association of Realtors® found that prices rose in 77% of metro markets across the US, with the national median home price at $426,800, well above the Chicago area at $360,000. Affordability remains an issue, especially for first-time buyers. Nationally, the share of first-time buyers dropped to a record low of 21% while the typical age of first-time buyers rose to an all-time high of 40 years, according to the National Association of Realtors.

"The historically low share of first-time buyers underscores the real-world consequences of a housing market starved for affordable inventory," said Jessica Lautz, NAR deputy chief economist and vice president of research. "The share of first-time buyers in the market has contracted by 50% since 2007 – right before the Great Recession.”

Mortgage interest rates are at 6.3% for a conventional 30-year fixed-rate loan. The Mortgage Bankers Association predicts that rates will remain at this level throughout 2026. Fannie Mae is slightly more optimistic, predicting a decrease in rates to 5.9% by the end of 2026.

Demand for housing is being supported by a strong US economy. Real Gross Domestic Product (GDP) increased at an annual rate of 3.8% due to a decrease in imports, rising consumer spending and an increase in personal income. Consumer confidence is down due to inflation fears, with inflation rising 3% in September, and worries about the job market as hiring has slowed and the unemployment rate rose slightly to 4.4%, according to an estimate by the Federal Reserve Bank of Chicago. The Chicago area economy is also showing strength as unemployment fell in the Chicago area by 0.6% to 4.4% in October, real GDP in Illinois rose 4.8%, and consumer spending rose 5.4%. Inflation in the Chicago metro area is 2.9% according to the US Bureau of Labor Statistics.

In today’s market, you need an experienced professional to guide you to success. If you are thinking of buying or selling a home, contact us today!