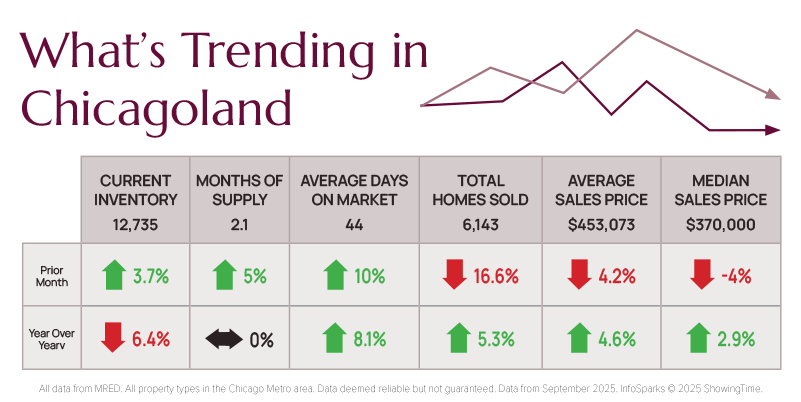

It’s fall in Chicagoland, and the market is experiencing its usual seasonal slowdown as temperatures begin to cool. Inventory fell annually by -6.4% to 12,735 homes, remaining historically low. Low inventory is keeping prices higher on average, with the median home price in Chicagoland at $370,000, up 2.9%. In the Chicagoland area, 6,143 homes were sold in September, a 5.3% increase from September 2024.

For context, in September five years ago, there was an inventory of 29,535 for-sale homes and sales of 12,630 homes. The average sales price in 2020 was $342,363, compared to $453,073 today, representing a 32.3% increase. Annual price growth has been steady, and there is nothing on the horizon that seems to contradict this pattern. Price growth has also been stronger in the suburbs.

Driving the demand for homes is the amazingly resilient US economy. Gross Domestic Product grew in Q2 by 3.8% and according to the GDPNow model by the Atlanta Federal Reserve, Q3 is expected to also grow at 3.8%. Manufacturing is up 2.7% in Q2, and durable goods orders are up 5%. The S&P 500 stock index is up 30% since its low in April. Unemployment is low at 4.3% but job growth has fallen back. In August, only 22,000 new jobs were created, and according to FactSet, there were about 50,000 jobs created in September. Compared to average monthly job gains of 186,000 in 2024, these numbers are concerning. Still, wages grew a healthy 4% year to date, well ahead of 2.7% inflation.

Because of concerns over the low job numbers, the Federal Reserve lowered interest rates by .25% in their September 17th meeting. Mortgage rates for 30-year conventional loans are hovering around 6.5%. Most economists expect interest rates to fall further and predict the housing market will benefit from a more balanced spring market that offers buyers more inventory and increased affordability.

Now is the perfect time to make your move in real estate. Let our experience guide you to success—contact Starck today to get started.