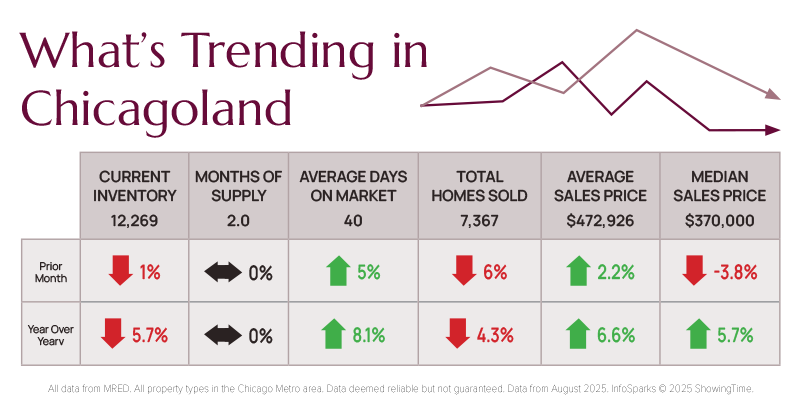

Home sales in the Chicago area declined by -4.3% since July 2024, largely due to the continued shortage of inventory. Prices rose on average by +6.6% annually as the inventory of available homes fell by -5.7%. Chicagoland remains a seller's market. The forecast by the Institute for Housing Studies at DePaul University calls for a seasonal decline in sales in the remaining months of 2025 by -18.7% with prices dropping -2.2%. That would still leave prices up +8.7% on an annual basis at year’s end.

Nationally, the inventory of homes for sale rose +15.7% to 1.55 million homes, the highest inventory since the 2020 lockdown. The national average home price is $422,400, up 0.2% since 2024. US housing wealth is at a record high of $55.1 trillion, up $20 trillion since 2020. Foreclosures rose 18% year over year in a sign that some households may be under strain.

According to the Wall Street Journal, mortgage rates now average 6.35% on a conforming 30-year, fixed-rate loan, down from 7% in January. The Bureau of Labor Statistics issued one of the largest revisions in its history, reducing the number of jobs created in the last year by 911,000 jobs. This indicates that the economy has been much weaker than previously thought. Consequently, the Federal Reserve Open Market Committee lowered overnight banking rates by .25% on September 17. Core inflation remains at 3%, higher than the Fed’s target rate of 2%, but the obvious weakness in the job market outweighs those concerns. Jerome Powell, Chairman of the Federal Reserve, indicated that more cuts will come before the end of the year.

Once the Fed starts lowering rates, it will take time for that to influence mortgage rates. But if mortgage interest rates fall below 6%, experts project that the real estate market will improve. Sellers who are sitting on mortgages with pandemic low rates will have an incentive to sell. Lower rates will also make it easier for buyers to qualify.

The economy is hard to gauge as the usual indicators are mixed. In Q2, the Gross Domestic Product grew by 3.3%. Unemployment rose slightly to 4.3% with low job creation but limited job losses. Consumer sentiment is falling, and spending on durable goods has fallen. Economists predict that the full effect of tariffs have not yet been felt, and prices on imports and goods requiring imported raw materials for their manufacture will eventually add to inflation. Meanwhile, the stock market is making record gains.

If you’re having a tough time figuring out the real estate market, contact Starck Real Estate.