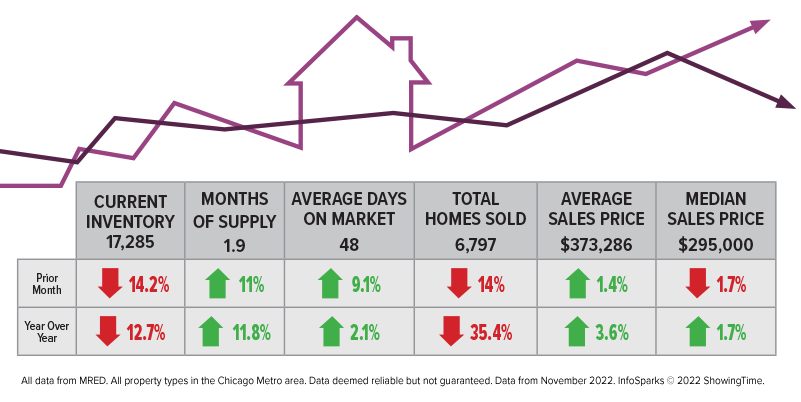

Average sales prices in the Chicagoland area are 3.6% higher than last year. Month on month sales prices have fallen for 4 straight months until November when they ticked up 1.4% over October. Sales have gone down over the last 3 months but that is typical going into the winter season. While annual prices are up, annual closed sales are down 33%.

Forecasts for 2023 by the major research firms like Morgan Stanley, KPMG, Moody’s Analytics, Fannie Mae, ING, and Zelman Associates all point to falling home prices in the New Year. Realtor.com, CoreLogic, and The Mortgage Bankers Association are predicting slight price increases. The experts can’t seem to agree.

Why is there so much uncertainty in the housing market? Very simply, because of the war in Ukraine, oil prices, China’s lockdown policies, and inflation the world situation is very uncertain at this time. The world economy is highly integrated. If the war in Ukraine deepens (causing more food, oil, and gas price shocks) and China continues its drastic COVID lockdowns (creating supply chain issues) that will play to the downside. If the conflict in Ukraine reaches a negotiated settlement and China opens up its economy again, then commodity prices will fall, supply chains will free up, and the housing market will improve.

In spite of the uncertainty, few analysts expect another 2008 style recession because of stringent mortgage underwriting, healthy home equity margins by most homeowners, an economy that is generating an average 392,000 jobs per month, and GDP growth of 2.9%. Mortgage rates peaked on November 10 at an average 7.08% for a 30-year conventional loan. Rates are now averaging 6.33% according to Freddie Mac. Inflation fell from 9.1% in June to 7.1% in early December as the Fed tightened up the money supply with higher interest rates and Treasury bond sales.

While prices are up in the Chicago area, the Case-Shiller National Home Price Index shows prices nationally falling 2.2%. But there is no reason to panic. Since the Pandemic Boom US home prices are up 40%. Average Chicago area prices have increased 25% in that time and are still rising. The market is rebalancing rather than falling. Be glad you live in the Chicago area because it is much less volatile than many other real estate markets!

Real estate is local! National statistics do not necessarily reflect local realities. That’s why you need a professional to guide you through what is happening in your area. Contact us today for a free analysis of your situation.